Key Takeaways

- Businesses that make, sell, or distribute packaged products will soon feel the effects of new environmental regulations for packaging materials enacted in five U.S. states.

- These regulatory regimes are based on the principle of extended producer responsibility (EPR), and they will impose detailed reporting requirements and potentially substantial fees on affected organizations.

- EPR packaging policies are designed to reduce packaging waste, increase the recycling rates of packaging materials, expand and improve municipal recycling systems and prod businesses to develop more eco-friendly packaging.

- However, these policies will unfairly penalize businesses that use fiber-based packaging if they don’t adequately reflect that such materials are already recycled at high rates and that a robust recycling infrastructure and responsible end markets for these materials already exist.

- To avoid this unfairness, organizations across the whole fiber-based packaging value chain need to become actively involved in shaping the content of EPR packaging laws, regulations, and programs.

What Is Extended Producer Responsibility?

Extended producer responsibility, or EPR, is the term for environmental policies that make producers responsible for the entire life cycle of their products, including the end-of-life cost of recycling or disposing of those products. EPR-based policies are widely regarded as one of the vital components of a circular economy.

EPR laws aren’t new, but they were first applied to products that were difficult to recycle and problematic when disposed of in municipal solid waste streams. For example, EPR programs were (and still are) used for electronics, batteries, paint, and mattresses. According to the Product Stewardship Institute, 33 U.S. States have enacted 141 EPR laws across 20 product categories including packaging.

Packaging has become a primary focus of recent EPR laws because of growing concerns about the environmental and health hazards of packaging waste, particularly plastic waste. European nations began adopting EPR laws for packaging in the 1990s, and British Columbia implemented the first Canadian EPR packaging program in 2014.

EPR Packaging Laws in the United States

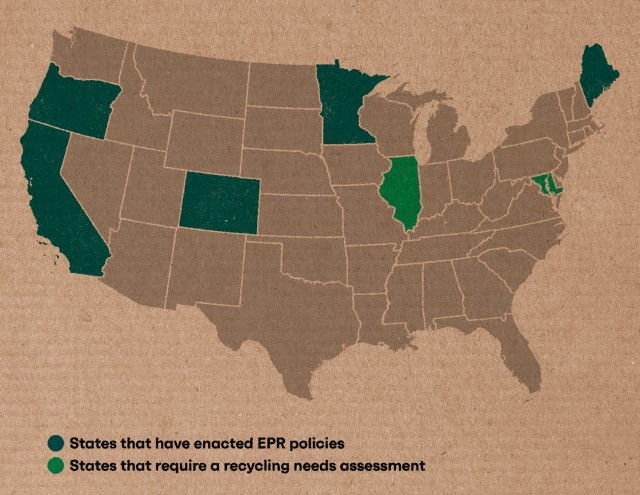

Five U.S. states—California, Colorado, Maine, Minnesota and Oregon—have already enacted EPR packaging laws and similar legislation has been introduced in another nine states. Illinois and Maryland have laws requiring the state to conduct a recycling needs assessment, the results of which will be used to guide the development of future EPR packaging laws in those states.

The implementation process in the five states with EPR packaging laws is underway, but the timelines vary. EPR packaging programs in these states are scheduled to begin at various times between 2025 and 2029.

At the federal level, the “Break Free From Plastic Pollution Act” was introduced in the Senate and House of Representatives on October 25, 2023. If enacted, this legislation would establish a nationwide EPR packaging program. However, it contains several other provisions that many business leaders are likely to find objectionable.*

*As introduced, the Break Free From Plastic Pollution Act would go far beyond establishing a national EPR packaging program. For example, it would create a beverage container refund program, place a fee on paper and reusable bags, ban single-use plastic bags and impose a moratorium on permitting facilities that produce plastics.

Some business leaders have expressed general support for the idea of a national approach to EPR for packaging. For example, during a Senate hearing held to explore the potential role of the federal government in packaging EPR, H. Fisk Johnson, chairman and CEO of S.C. Johnson & Son, said, “We believe federal EPR is the way to go.” Johnson argued that a federal framework would enable companies to avoid over-regulation and “expensive, ineffective, piecemeal approaches.”

How EPR Packaging Laws Work

EPR laws for packaging are often described in rather simplistic terms, but the reality is that these laws create complex regulatory regimes. | See sidebar, "When EPR also applies to paper"

EPR packaging programs have several key objectives. Most are specifically designed to:

- Increase the recycling rates of packaging materials by increasing access to recycling and making it more convenient for consumers

- Provide a consistent and reliable source of funds to operate, improve, and expand recycling capabilities and facilities

- Provide incentives for businesses to design and use more eco-friendly packaging

- Encourage the development of responsible end markets for recycled materials

- Educate consumers about the availability, mechanics, and benefits of recycling

To achieve these objectives, EPR packaging laws require certain businesses (typically called “producers”) that make, sell, or distribute packaged products to pay the costs of recycling or disposing of the packaging associated with those products. Some of these laws make producers operationally responsible for managing the state’s recycling system.

Business organizations classified as producers are required to join a producer responsibility organization (PRO). EPR packaging laws typically require a PRO to:

- Develop a program plan that will satisfy the requirements and meet the objectives of the EPR packaging statute

- Determine the estimated cost of implementing the program plan

- Determine the fees to be paid by producers based on the estimated program costs and any other relevant requirements of the EPR packaging statute

Many packaging-focused EPR laws require the state or the PRO to conduct an in-depth recycling needs assessment. The overall objective of this assessment is to describe the existing capabilities of the state’s recycling system and identify what improvements will be needed to enable the system to meet the requirements and objectives of the EPR packaging law.

Some EPR packaging laws also include quantitative targets of various kinds, such as:

- Recycling rate targets – The percentage of a type of product or material that is collected and recycled

- Recyclability targets – The percentage of packaging materials (or specific types of materials) that must be recyclable (or compostable) by a specified date

- Recycled content targets – Targets that prescribe minimum post-consumer-recycled-content rates for certain types of packaging materials

EPR packaging statutes also prescribe the kinds of costs that will be funded through the EPR program. These costs may include the operating costs of the recycling services described in the program plan, the costs of any required improvements or enhancements to the state’s recycling system and the cost of any public education programs required by the statute.

All these factors are used to determine the total amount of money the PRO will need to meet its obligations under the EPR packaging law and therefore the total amount of the fees the PRO must charge producers.

EPR laws for packaging typically provide that the amount of the fees charged to an individual producer will be based on the amounts and types of packaging materials the producer generates during a specified period. The statutes usually require the PRO to set fee rates for various types of material that reflect the ease of recycling and the cost of processing each material type.

Most EPR packaging laws also expressly require or permit the use of eco-modulation to reduce or increase the fees payable by individual producers. The objective of eco-modulation is to incentivize businesses to reduce the environmental impacts of their packaging.

For example, the Oregon EPR packaging statute specifically requires the PRO to offer fee adjustments that will result in lower fees for packaging with a lower environmental impact and higher fees for packaging with a higher environmental impact.

The statute goes on to provide that in establishing the criteria for eco-modulated fees, the PRO must consider:

- The post-consumer content of the material

- The product-to-package ratio

- The producer’s choice of material

- Life cycle environmental impacts

- The recycling rate of the packaging material relative to the recycling rates of other packaging materials

Are EPR Packaging Programs Effective?

A substantial body of evidence demonstrates that EPR programs for packaging will, over time, increase the recycling rates of packaging materials.

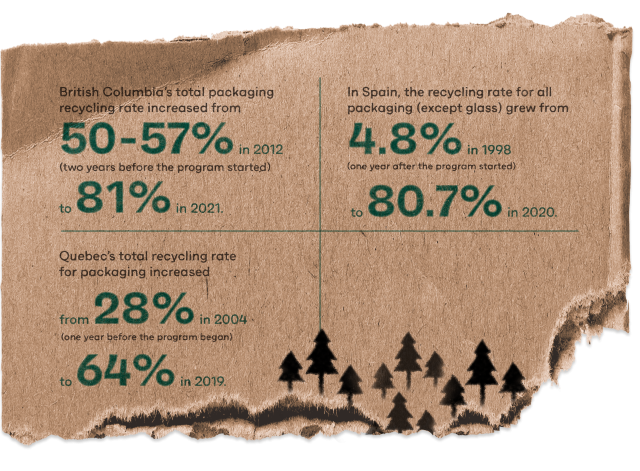

In 2023, The Recycling Partnership examined the performance of EPR packaging programs in seven jurisdictions across Europe, Canada and Asia. At the time of the study, these programs had been operating for several years, so there was sufficient data to evaluate their performance over time.

The scope and other details of the programs varied, but all produced modest to significant growth in the recycling rates for packaging materials.

For example:

In 2021, Eunomia Research & Consulting Inc. analyzed the EPR packaging programs in France, Germany, and Italy. The analysis found that the total packaging recycling rate in Germany increased from 37.7% in 1991 (the year before the EPR program started) to 76.2% in 2016.

The Eunomia study also revealed that recycling rates for packaging materials increased by about 10% in France and about 8% in Italy from 2008 through 2018.

Why You Need to Make Your Voice Heard

The objectives of EPR programs for packaging are laudable, and multiple research studies have confirmed that these programs drive increased recycling rates and thus keep tons of packaging materials out of landfills.

However, if EPR packaging policies aren’t thoughtfully developed and implemented, they can require businesses that use and rely on fiber-based packaging materials to pay more than their fair share of the costs of an EPR packaging program. This unfairness arises when such policies do not adequately reflect two factors that differentiate fiber-based packaging from other types of packaging materials. | See sidebar, “International Paper’s Views on EPR for Packaging”

First, fiber-based packaging materials are already recycled at higher rates than other packaging materials. The American Forest & Paper Association has reported that 71-76% of cardboard boxes, also known as old corrugated containers (OCC) and 65-69% of paper, were recycled in 2023.

According to the U.S. Environmental Protection Agency, the recycling rate of paper and paperboard containers and packaging was 80.9% in 2018 (the last year for which EPA data is available). The 2018 recycling rates of other common packaging materials were significantly lower – plastics (13.6%), glass (31.3%), aluminum (34.9%).

The second factor that separates fiber-based packaging from other forms of packaging is that a robust, market-driven recycling infrastructure and responsible end markets already exist for many fiber-based packaging materials.

The primary emphasis of EPR packaging programs is to improve the performance of residential/consumer recycling systems because that is where the greatest opportunities for improvement exist. However, a substantial amount of used fiber-based packaging materials, particularly OCC, is generated by business organizations and institutions.

Many business organizations and institutions manage their OCC through contracts with recycling service providers. In 2023, for example, International Paper directly or indirectly managed over 7 million tons of OCC and other fiber-based materials acquired from business enterprises and pre-consumer packaging converters. After processing, the resulting fiber was used to manufacture new cardboard packaging material.

The important point is that fiber-based packaging materials managed via these types of private-sector arrangements do not place any demands on the recycling systems that EPR programs for packaging are designed to improve.

These and other issues make it important for organizations across the fiber-based packaging value chain to play an active role in shaping the content of EPR packaging policies.

In states that have not yet enacted EPR packaging laws, stakeholders in the fiber-based packaging value chain should actively engage with lawmakers to ensure that EPR packaging statutes don’t require producers of fiber-based packaging materials to pay a disproportionate share of EPR packaging program costs.

In states that have already enacted EPR laws for packaging, stakeholders can still make their voices heard by commenting on proposed regulations during the rulemaking process. Stakeholders may also have the opportunity to comment on the program plan developed by the PRO before it’s approved by the state.

EPR packaging policies represent an important step on the journey to a circular economy, but these policies should not penalize an industry that has already made substantial strides toward sustainable packaging.

When EPR Also Applies to Paper

Three of the five states that are implementing EPR programs for packaging—Colorado, Minnesota, and Oregon—have statutes that also include paper products.

These states use the same general regulatory framework for both paper products and packaging, although there are some necessary differences. The most notable differences relate to what paper products are covered and what types of organizations are classified as producers.

What Products Are Covered?

All three states begin with a broad “definition” of paper products, but all three statutes contain numerous exclusions and/or exemptions. Paper products that are completely or partially exempt or excluded in some or all of these statutes include:

Bound books

Newspapers

Magazines

Tissue paper and paper towels

Paper products sold or supplied in connection with prescription or nonprescription drugs

Printed paper used to distribute documents (e.g. financial statements, billing statements, medical records, etc.) required by law to be provided in paper form

Paper products sold or supplied in connection with infant formula or medical food

Who Are “Producers” of Paper Products?

The statutes in all three states generally provide that, for paper products that are magazines, catalogs, telephone directories, or “similar” publications, the producer is the publisher.

For other paper products, each statute generally follows the same definition framework that it uses to specify who the producer is of packaging materials. Depending on the circumstances, the producer of a paper product can be the brand owner or the manufacturer, distributor, or importer of the product.

How Much Impact Will These Programs Have?

Given the numerous exemptions and exclusions in these statutes, it’s reasonable to ask: How much impact will these EPR paper programs have?

Data from the U.S. Environmental Protection Agency shows that in 2018 (the last year for which such data is available), nonpackaging paper and paperboard products represented 8.7% of the total municipal solid waste generated in the United States.

If you eliminate books, newspapers, magazines, and tissues/towels (using 2018 tonnage amounts), the remaining amount of nonpackaging paper and paperboard would represent only 5% of the total municipal solid waste generated in 2018.

Of course, the amounts of these products will have changed since 2018. But, the EPA data suggest that the EPR paper programs in Colorado, Minnesota, and Oregon may impact only a small percentage of the municipal solid waste generated in those states.

International Paper’s Views on EPR for Packaging

International Paper (NYSE: IP) is a global producer of sustainable packaging, and one of the world’s largest recyclers, operating 16 recycling plants in the United States. For more information about IP’s commercial recycling services, visit internationalpaper.com/recycling.

David Kluesner is IP’s Director of State Government Relations. In the following conversation, David discusses IP’s position on ERP packaging laws and IP’s concerns regarding the potential impacts of those laws.

What is International Paper’s overall position on EPR laws for packaging, and what are IP’s main concerns regarding such laws?

David Kluesner: We oppose the inclusion of recyclable, compostable fiber-based packaging in EPR laws.

In the United States, EPR for packaging initiatives grew out of concerns over the impacts of plastic waste on the environment. In fact, many EPR for packaging proposals include “plastic” in the name. This is understandable. According to the U.S. Environmental Protection Agency, the recycling rate for plastic waste is roughly 9%, while the rate for paper is nearly 70% and for corrugated packaging, the number is more than 90%.

This is not an accident. Our industry invests massive amounts of capital to expand our paper recycling capacities. According to the Northeast Recycling Council, North American paper mill owners announced 25 recycling expansion projects for the years 2017-2024 that have the potential to use an additional eight million tons of old corrugated containers (OCC) and mixed paper. This is on top of the more than 45 million tons of recovered fiber the industry already consumes.

The result is a robust market, driven by increasing demand for a valuable commodity. Plastic waste is a different story. Much of the material has little value and end markets are limited if they exist at all.

Most EPR proposals are similar in structure. In the most basic sense, they create unelected Producer Responsibility Organizations (PRO), and give them the authority to levy fees on packaging materials and then disburse those funds to recycling programs. Membership in these PRO’s is often reserved for the consumer brands that introduce plastic packaging into the economy in the first place. They face pressure to do something about this problem. EPR for packaging laws provide them with a mechanism to force the manufacturers and users of highly recycled materials to pay for the problems inherent in the recovery and recycling of plastic packaging waste.

How would an EPR regulatory system for packaging impact businesses that use fiber-based packaging and other participants in the value chain of fiber-based packaging?

David Kluesner: The Associated Press recently published an article entitled “So long plastic air pillows: Amazon shifting to recycled paper filling for packages in North America.” This shift is happening because consumers understand the inherent problems associated with plastic packaging and are demanding sustainable alternatives. Companies like Amazon are responding in kind. EPR programs that treat all materials the same, or worse, force highly recycled materials to subsidize poor performers, fly in the face of this societal trend. There must be a meaningful policy differentiation based on recycling performance.

How would the adoption of EPR laws for packaging impact the existing recycling infrastructure for fiber-based packaging materials?

David Kluesner: Some of the new EPR proposals include post-consumer recycled content mandates for packaging. The system our industry has developed ensures recovered fiber flows into the right products in the right geographic areas. Requiring arbitrary post-consumer content mandates would distort our existing supply chains, and result in unintended consequences such as increased greenhouse gas emissions and additional costs for consumers.

Can EPR laws be improved from the perspective of businesses that use fiber-based packaging and other stakeholders in the fiber-based packaging value chain? If so, what changes would International Paper recommend?

David Kluesner: Recall that EPR for packaging was supposed to address the problem of materials with very low recycling rates and little market value; namely plastics. We believe a fair, workable solution was incorporated into the California EPR law passed in 2022. Golden State lawmakers included a provision that provides an offramp for materials that can meet an aggressive, statutorily set recycling rate. This provides an incentive for producers and consumers to choose sustainable, recyclable packaging materials. It is now up to our industry to demonstrate that we can meet this standard, and we believe we will.

Does International Paper have any other views regarding EPR packaging laws?

David Kluesner: International Paper supports improvements in the nation’s recycling system. This is demonstrated by the investments we continue to make and the work we do with our customers to ensure our packaging is fully recyclable or compostable. We will continue to be active participants in this space and will work with our public and private partners to find workable solutions.